- Biz Analyst Club

- Posts

- Deep Dive: Modernizing Self-Storage (Urban Storage) [Premium PDF Report]

Deep Dive: Modernizing Self-Storage (Urban Storage) [Premium PDF Report]

A Comprehensive Analysis of the $47+ Billion Market Opportunity

The average apartment just shrunk to 649 square feet. That's smaller than a two-car garage. Portland followed suit at 668 square feet. San Francisco isn't far behind.

As cities get denser and living spaces get tighter, a massive opportunity is emerging that most investors haven't noticed yet. It's not sexy. It's not high-tech (well, not entirely). But it's generating 46.6% EBITDA margins for those who understand the shift.

I'm talking about the transformation of self-storage from sleepy real estate investment to urban goldmine.

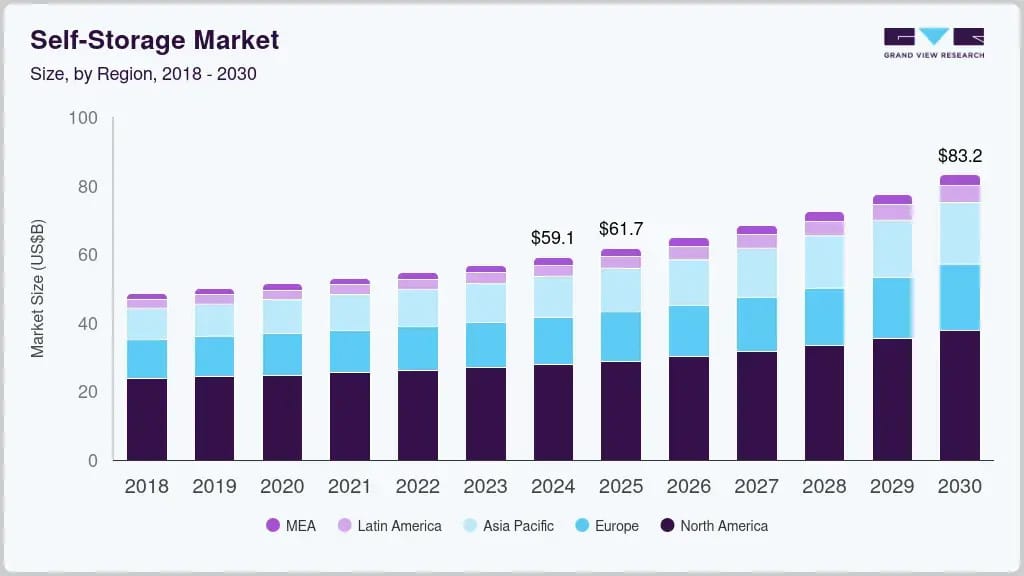

Source: grandviewresearch.com

The $47 Billion Question

The global self-storage market will grow by $47 billion over the next decade. But here’s what the headlines miss: this isn’t about traditional storage anymore. The old model of building large facilities on cheap suburban land is fading fast.

What’s replacing it is far more interesting.

Urban storage operators are taking small footprints in dense neighborhoods, integrating smart technology, and capturing premium prices from city dwellers who urgently need space. When Singapore Post acquired Storefriendly for 15 times EBITDA in 2015, the industry paid attention. When that multiple continued to hold across subsequent transactions, sophisticated investors began moving in.

Deep Dive in Printable PDF and Docx format

Our latest Deep Dive examines this shift in depth. It’s not a standard market report. It’s a full analysis of how urban storage became attractive to venture capital, why the underlying economics are so strong, and how entrepreneurs are building these businesses from the ground up.

The report reveals:

✅ Why a single 8,000 sq ft urban facility generates $155,038 annually (and why five locations produce $815,152 with 46.6% margins)

✅ The technology stack enabling 70% labor cost reduction

✅ How climate-controlled units command 45-65% premiums

✅ The B2B revenue streams adding $8,500+ per location

✅ Why 87% of renters now demand app-based access

✅ The optimal unit mix for urban markets (40 micro, 20 small, 15 medium, 10 large units)

✅ Funding pathways from seed to Series C

✅ Exit strategies and valuation frameworks based on actual transactions

Take a peak of what's inside this Deep Dive:

Content preview

P.S. One detail that surprised us: the highest-margin storage units aren't the large ones. They're the micro-units for urban professionals storing just a few boxes. The psychology of pricing is fascinating and we explore it in detail.

Download the full PDF and Docx Deep Dive by clicking on the button below (Premium subscribers only):

Become a premium subscriber on Biz Analyst Club to read the rest.

Become a paying subscriber of Biz Analyst Club to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Access to this report and future ones

- • Monthly quick takes and analysis

- • Access to Deep Dives Analysis on Business Opportunities

- • Access to Deep Dives Analysis on Business Model Types